Transfer duty in South Africa: everything you need to know

evo’s guide to transfer duty provides all the need-to-know on calculating and paying this mandatory property tax.

Article summary

- A property transfer duty is a tax payable by buyers of all types of properties purchased for more than R1000 000

- Transfer duty is owed over and above the selling price and is based on the value, not the price of the property.

- Acquiring a property through marriage in community of property, divorce, inheritance, when a property transaction is cancelled and VAT transactions are some of the instances when transfer duty exemptions apply.

According to the Transfer Duty Act, property transfer duty is a tax payable by buyers of all types of properties and is owed over and above the selling price.

Mark Coetzee, Head of evo, explains that transfer duty should not be confused with transfer costs, which include all the expenses associated with a property transfer.

Everything you need to know about transfer duty

Here, evo’s guide to transfer duty in South Africa.

Who pays transfer duty?

When a home is acquired by a buyer, he or she becomes liable for transfer duty. Like all sale-and-purchase agreements in this country, the date of acquisition is considered to be the date on which the transaction was entered into – that is, the date on which the last-contracting party signed the agreement.

Coetzee notes that this rule applies regardless of whether the agreement is subject to conditions, such as the seller accepting the purchase offer only when the buyer obtains a bond – in this case, for instance, transfer duty applies from the date of the offer, not the date on which financing is approved.

Who takes care of my transfer duty payments?

A conveyancing attorney, responsible for the transfer of the property to your ownership, will handle transfer duty payments on your behalf.

Note that the transfer duty is separate from the fees you pay the conveyancing attorney for transferring the property, which can be calculated using the evo transfer cost calculator.

The seller usually appoints the conveyancing attorney but their cost is covered by the purchaser. This can make the fees quite challenging for the purchaser to negotiate and is something to keep in mind when signing your offer to purchase.

How is transfer duty calculated?

Transfer duty is calculated on the value – not the price – of the property, although, as Coetzee explains, SARS will generally regard the purchase price of the property to be its value.

However, he points out that if SARS believes that the purchase price does not correspond with the true value, which may be the case if, say, a property is sold to a family member and its value understated, transfer duty will have to be paid on the true or fair value.

Note: The transfer duty threshold has been raised

Originally, properties up to R900 000 in value were exempt from transfer duty, but that amount has been increased to R1000 000 as of March 2020. This allows some extra breathing space for property investors; an additional R100 000 they can spend on their purchase price before being subject to transfer duty.

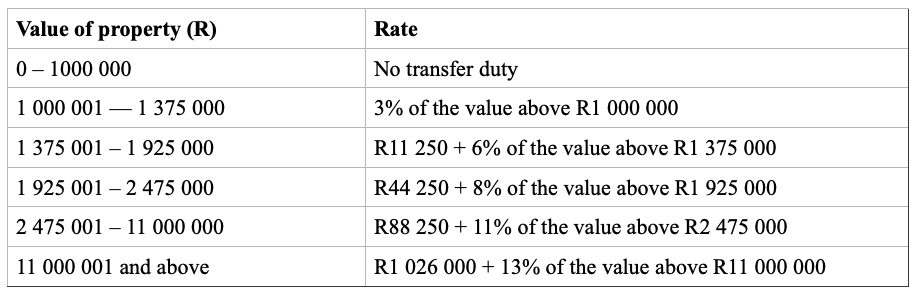

Transfer duty rates for 1 March 2020 to 28 February 2021

These are the transfer duty rates applicable on property purchased on or after 1 March 2020.

When VAT replaces transfer duty

By law, a transaction cannot be subject to both VAT and transfer duty and, in a property transaction, the payment of VAT always takes precedence over that of transfer duty where the seller is a VAT vendor.

Developers often use this marketing ploy to entice prospective buyers, offering homes with no transfer duty. Instead, buyers pay VAT on these homes, but this is more often than not included in the purchase price.

Transfer duty exemptions

Property transfers are exempt from transfer duty in the following circumstances:

- Marriage in community of property. If someone who owns a property gets married in community of property, his or her spouse will automatically become the owner of a half-share of the property, without paying any transfer duty.

- Divorce. Transfer duty does not apply if a property is awarded to a spouse in terms of a divorce order. The exemption applies to all marital regimes and to civil unions. However, if the property is not awarded to a spouse in terms of a divorce order and the parties reach an agreement outside of the formal divorce proceedings, the spouse who acquires the property will be liable for transfer duty.

- Inheritance. Heirs and beneficiaries are exempt from paying transfer duty on property inherited from a deceased estate, regardless of the nature of their relationship with the deceased and irrespective of whether or not the deceased died without a valid will.

- Cancelled transactions. If a property purchase is cancelled before the transfer is registered at the Deeds Office, there is no liability for transfer duty if SARS is satisfied that the cancellation is legitimate.

Understanding additional costs like transfer duty makes the home-buying process easier. To make the home-buying process that much easier, evo also offers a range of home loan calculators to help make the home-buying process easier. Get prequalified for a home loan with evo, then, when you’re ready, you can apply for a home loan with evo.